IRS final regs expand mandatory e-filing of many information returns

The IRS recently finalized regulations that substantially expand mandatory electronic filing (e-filing) of certain information returns. The regulations were proposed in 2021 to implement statutory changes made under the Taxpayer First Act of 2019. … [Continue reading]

Forming a cross-functional sales team

Business owners are often warned about silos. Not the tall, cylindrical structures typically seen on farms or at grain processing facilities. Rather, the insular nature of many departments that results in the hoarding of information and a distinct … [Continue reading]

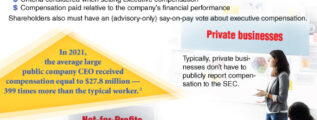

2023 – 03/02 – Spotlight on executive compensation

Small employers: Don’t forget about the new and improved pension credit

At the very end of 2022, President Biden signed into law the Setting Every Community Up for Retirement Enhancement 2.0 Act (SECURE 2.0). Now that the year is well underway, small employers would be well-advised not to forget about a key feature of … [Continue reading]

Supreme Court: Overtime rules still apply to highly compensated employees

If you were told someone earns more than $200,000 annually, you might assume the person is a salaried employee who’s ineligible for overtime pay. However, as demonstrated in the recent U.S. Supreme Court case of Helix Energy Solutions Group, Inc. v. … [Continue reading]

- « Previous Page

- 1

- …

- 37

- 38

- 39

- 40

- 41

- …

- 183

- Next Page »