In Notice 2020-66, the IRS recently determined that Medicaid coverage limited to COVID-19 testing and diagnostic services isn’t minimum essential coverage under a government-sponsored program. Thus, an individual’s eligibility for this coverage for … [Read more...]

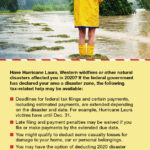

2020 – 09/10 – Tax relief for victims of natural disasters

Employers should approach payroll tax deferral cautiously

As you’re probably aware, President Trump signed an executive memorandum on August 8 creating a payroll tax deferral. The development has brought with it much uncertainty regarding administrative compliance and the long-term impact of this … [Read more...]

IRS relief addresses physical presence requirement for retirement plan signatures

Under IRS regulations regarding electronic consents and elections, if a signature must be witnessed by a retirement plan representative or notary public, it must be witnessed “in the physical presence” of the representative or notary unless guidance … [Read more...]

IRS addresses CARES Act relief for retirement plan distributions and loans

The IRS recently issued frequently asked questions (FAQs) regarding retirement plan distribution and loan relief under the Coronavirus Aid, Relief and Economic Security (CARES) Act. This relief applies to qualified individuals affected by the novel … [Read more...]

IRS extends some (but not all) employee benefit plan deadlines

The IRS recently issued Notice 2020-23, expanding on previously issued guidance extending certain tax filing and payment deadlines in response to the novel coronavirus (COVID-19) crisis. This guidance applies to specified filing obligations and other … [Read more...]

- « Previous Page

- 1

- …

- 22

- 23

- 24

- 25

- 26

- …

- 44

- Next Page »