IRS Issue Snapshot discusses deduction limits for “combination” retirement plans

The IRS occasionally publishes “Issue Snapshots” to provide an overview of a tax topic for its employees. Recently, the tax agency released “Issue Snapshot: Combined Limits under IRC Section 404(a)(7).” The publication discusses the limits on … [Read more...]

2021 – 10/28 – Business-to-business bartering has tax consequences

Leave tax credits are available for employees who help others get vaccinated

In News Release 2021-160, the IRS recently made an important announcement related to COVID-19 vaccinations. That is, wages paid for leave taken to accompany someone who’s getting vaccinated, or to care for someone recovering from a vaccination, may … [Read more...]

Work with your payroll provider to pay deferred taxes

Many of the relief measures passed by the federal government during the opening chapters of the COVID-19 pandemic are still relevant to employers. For example, under the CARES Act, you could defer payment of your share of Social Security taxes from … [Read more...]

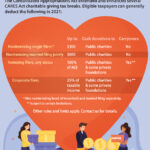

2021 – 07/01 – 2021 tax breaks for charitable donations

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 24

- Next Page »