A transparency provision included in the Consolidated Appropriations Act (CAA) requires group health plans to annually submit health care and drug cost reports to the U.S. Department of Labor, Department of Health and Human Services, and the … [Read more...]

Use change management to brighten your company’s future

Businesses have had to grapple with unprecedented changes over the last couple years. Think of all the steps you’ve had to take to safeguard your employees from COVID-19, comply with government mandates and adjust to the economic impact of the … [Read more...]

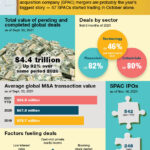

2021 – 11/24 – 2021 shapes up to be a record year for M&As

IRS announces adjustments to key retirement plan limits

In Notice 2021-61, the IRS recently announced 2022 cost-of-living adjustments to dollar limits and thresholds for qualified retirement plans. Here are some highlights:Elective deferrals. The annual limit on elective deferrals (employee contributions) … [Read more...]

2021 – 11/18 – Don’t lose your deduction in the wash

Ready for sipping: 2022 fringe benefit COLAs

The IRS recently released 2022 cost-of-living adjustments (COLAs) for a wide variety of tax-related limits, including those related to many popular fringe benefits. Care to take a sip? Here are some highlights:Health Flexible Spending Accounts … [Read more...]

- « Previous Page

- 1

- …

- 49

- 50

- 51

- 52

- 53

- …

- 105

- Next Page »