For businesses, and people for that matter, the beginning of the calendar year can be a bit of a grind. The holidays have passed, summer vacations are relatively far off and everyone is trying to build momentum for a strong, healthy year.Amongst all … [Read more...]

2024 – 02/01 – Be aware of IRS audit red flags

Employers: Beware of payroll tax errors

Many employers rightly proclaim that their employees are their most valuable assets. If this holds true for your organization, it stands to reason that paying those employees consistently and accurately is among the most important things you must … [Read more...]

2024 – 01/25 – Not all legal damages awards are taxable

Seeing the big picture with an enterprise risk management program

There’s no way around it — owning and operating a business comes with risk. On the one hand, operating under excessive levels of risk will likely impair the value of a business, consume much of its working capital and could even lead to bankruptcy if … [Read more...]

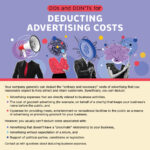

2024 – 01/18 – Deducting advertising costs for businesses

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 105

- Next Page »